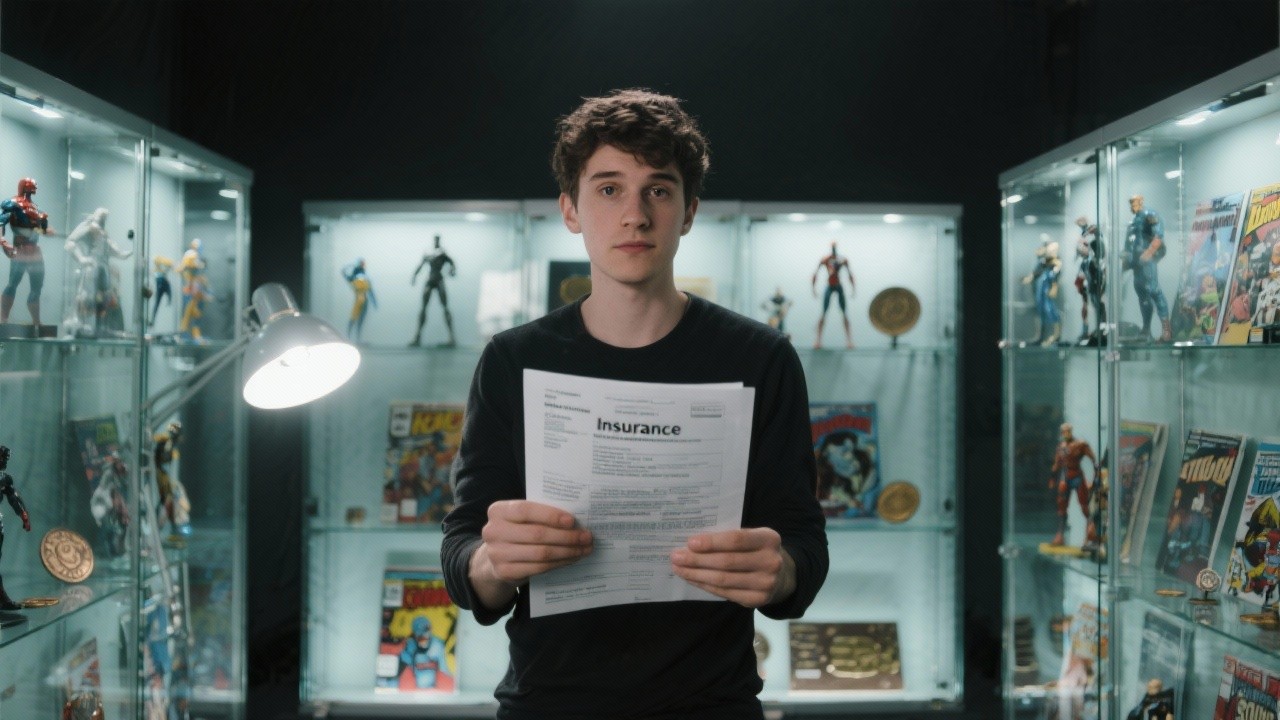

Introduction: Why Your Collection Needs More Protection Than You Think

Imagine discovering that your prized baseball card collection, carefully assembled over decades and worth $50,000, would only be covered for $1,500 if stolen from your home. This shocking reality faces millions of collectors who rely solely on their homeowners insurance for protection. The truth is that standard homeowners policies typically impose severe sublimits on collectibles, leaving passionate collectors exposed to devastating financial losses.

In 2025, the collectibles market has reached unprecedented heights, with rare trading cards selling for millions, vintage toys commanding five-figure prices, and even modern collectibles like sneakers becoming serious investment assets. Yet despite these soaring values, most collectors remain dangerously underinsured, unaware that their homeowners policy might cover less than 5% of their collection’s actual value.

This comprehensive guide explores everything you need to know about collectibles insurance, from understanding why your homeowners policy falls short to choosing the right specialized coverage for your unique collection. Whether you collect stamps, coins, comic books, fine art, or any other treasured items, this article will equip you with the knowledge to properly protect your valuable investments and ensure that years of careful collecting aren’t wiped out by a single unfortunate event.

Understanding the Dangerous Gap in Your Homeowners Insurance

Most collectors assume their homeowners insurance provides adequate protection for their valuable collections. This assumption often proves catastrophically wrong when they file a claim. Standard homeowners policies treat collectibles as regular personal property, but with strict sublimits that can leave collectors facing massive out-of-pocket losses.

The concept of sublimits represents one of the most misunderstood aspects of homeowners insurance. While your policy might provide $100,000 in personal property coverage, specific categories of items face much lower limits. According to insurance industry standards, typical sublimits include $1,500 for jewelry, $2,500 for firearms, $2,000 for silverware, and often just $200 for coins and currency. These limits apply regardless of your collection’s actual value or your overall personal property coverage limit.

The mathematics of these sublimits can be devastating for serious collectors. Consider a collector with a $75,000 comic book collection stored in their home. If their collection is destroyed in a fire, their homeowners policy might only pay out $1,500 under the collectibles sublimit, leaving them with a $73,500 loss. This represents a coverage gap of over 98%, a financial disaster that could take decades to recover from.

Critical Warning: Many collectors don’t discover these sublimit restrictions until after a loss occurs. By then, it’s too late to obtain proper coverage. Review your homeowners policy today to understand exactly what sublimits apply to your collections.

Common Homeowners Insurance Sublimits for Collectibles

| Category | Typical Sublimit | Common Collection Values | Coverage Gap Risk |

|---|---|---|---|

| Jewelry & Watches | $1,000 – $2,500 | $10,000 – $100,000+ | Extreme (75-98%) |

| Coins & Currency | $200 – $500 | $5,000 – $50,000+ | Extreme (95-99%) |

| Stamps | $1,000 – $1,500 | $5,000 – $25,000+ | High (80-95%) |

| Trading Cards | $1,000 – $2,000 | $10,000 – $500,000+ | Extreme (90-99%) |

| Fine Art | $1,000 – $5,000 | $25,000 – $1,000,000+ | Extreme (80-99%) |

| Firearms | $2,000 – $2,500 | $10,000 – $50,000+ | High (75-95%) |

| Comics & Toys | $1,000 – $2,500 | $5,000 – $100,000+ | High to Extreme (80-98%) |

| Wine Collection | $500 – $1,500 | $10,000 – $200,000+ | Extreme (85-99%) |

What Is Collectibles Insurance and How Does It Work?

Collectibles insurance is specialized coverage designed specifically to protect valuable collections that exceed the limited protection offered by standard homeowners policies. Unlike homeowners insurance that treats collectibles as ordinary personal property with restrictive sublimits, collectibles insurance recognizes the unique value and risks associated with collecting.

This specialized insurance operates on fundamentally different principles than standard property coverage. According to Collect Insure, a leading collectibles insurer since 1966, these policies provide coverage based on the actual collector value of items rather than depreciated cash value. This means if your vintage Star Wars figure collection is destroyed, you’ll receive enough to replace the items at current market prices, not what you originally paid decades ago.

The structure of collectibles insurance offers flexibility that standard policies can’t match. You can choose between blanket coverage that protects your entire collection up to a specified limit, scheduled coverage that lists individual high-value items, or a combination of both approaches. This flexibility allows collectors to optimize their coverage based on their collection’s unique characteristics while managing premium costs effectively.

One of the most significant advantages of collectibles insurance is its broader coverage scope. While homeowners policies typically exclude many common risks, collectibles insurance often covers accidental breakage, mysterious disappearance, flood damage (usually excluded from homeowners policies), damage during transit or shipping, depreciation in value after partial damage, and even coverage while items are displayed at shows or exhibitions.

Types of Coverage Options Available

Understanding the different coverage options available for collectibles insurance helps you choose the right protection for your specific situation. Each coverage type offers distinct advantages depending on your collection’s nature, value, and how you use it.

Agreed Value Coverage

Agreed value coverage represents the gold standard for protecting high-value individual items. With this coverage, you and the insurer agree on each item’s value upfront, typically based on recent appraisals or documented market values. Chubb Insurance notes that for covered total losses under agreed value policies, collectors receive 100% of the agreed value as a cash settlement, eliminating disputes about value at claim time.

This coverage type works exceptionally well for unique, rare, or particularly valuable items where establishing value after a loss would be difficult. For example, if you own a one-of-a-kind piece of original comic art valued at $50,000, agreed value coverage ensures you’ll receive exactly $50,000 if it’s destroyed, regardless of market fluctuations or depreciation arguments.

Blanket Coverage

Blanket coverage provides protection for entire collections under a single coverage limit without requiring individual item scheduling. This approach works perfectly for collections with many similar items of moderate individual value, such as stamp collections, coin collections, trading card collections, or vinyl record collections.

According to American Collectors Insurance, blanket coverage simplifies the insurance process by eliminating the need for detailed inventories of every item, though collectors should maintain their own records for claim purposes. Coverage limits can range from a few thousand dollars to several million, depending on the insurer and collection type.

Scheduled Item Coverage

Scheduled item coverage allows you to specifically list individual pieces or sets with their respective values. This hybrid approach combines the specificity of agreed value coverage with the flexibility to adjust values as your collection grows or market conditions change. Items are individually listed on your policy with specific coverage amounts, providing clear documentation for both you and the insurer.

Pro Tip: Many collectors use a combination approach – scheduling their most valuable pieces individually while using blanket coverage for the bulk of their collection. This strategy optimizes both coverage quality and premium costs.

Coverage Types and Premium Comparison

| Coverage Type | Best For | Typical Premium Rate | Documentation Required |

|---|---|---|---|

| Agreed Value | High-value individual items | 0.5-1.5% of value annually | Appraisal or purchase receipt |

| Blanket Coverage | Large collections of similar items | 0.3-1.0% of value annually | General inventory list |

| Scheduled Items | Mixed collections with standout pieces | 0.4-1.2% of value annually | Detailed list with values |

| Inflation Guard | Appreciating collections | +10-20% to base premium | Initial documentation only |

What Types of Collections Can Be Insured?

The range of collectibles that can be insured has expanded dramatically as the collecting market has evolved. Modern collectibles insurance covers virtually anything with established collector value and a secondary market, from traditional collections to contemporary items that previous generations wouldn’t have considered collectible.

Traditional Collectibles

Traditional collecting categories remain the backbone of the collectibles insurance market. These include stamps and postal history, with collections ranging from classic rarities to modern limited editions. Coin and currency collections, including ancient coins, gold and silver bullion, and rare paper money, represent another major category. Fine art and sculptures, whether old masters or contemporary works, require specialized coverage due to their unique valuation challenges and conservation needs.

Sports memorabilia has evolved into one of the most dynamic collecting categories, encompassing game-worn jerseys, autographed items, vintage equipment, and the explosively popular trading card market. According to recent market data, some modern sports cards now rival fine art in value, with individual cards selling for millions of dollars.

Modern and Pop Culture Collectibles

The definition of insurable collectibles has expanded to include numerous modern categories. Comic books and original comic art have become serious investment assets, with key issues and original pages commanding six and seven-figure prices. Vintage toys and action figures, particularly items from the 1970s and 1980s still in original packaging, have seen tremendous appreciation.

Video game collections, including sealed vintage games and rare hardware, now qualify for coverage as values have skyrocketed. Modern categories also include designer sneakers and streetwear, vintage concert posters and music memorabilia, movie props and entertainment memorabilia, and even NFTs and digital collectibles with established markets.

Specialized Collections

Insurance providers have adapted to cover increasingly specialized collections. Wine collections require unique considerations for storage conditions and spoilage risks. Watch collections, from vintage Rolexes to modern limited editions, need coverage that accounts for both wearing and displaying these functional collectibles. Musical instruments, particularly vintage guitars and orchestral instruments, require policies that cover both their collectible value and potential use.

Military memorabilia, including uniforms, medals, and historical artifacts, presents unique valuation challenges. Historical documents and manuscripts, from presidential signatures to literary manuscripts, require specialized handling and storage considerations that insurance must address.

How Much Does Collectibles Insurance Cost?

Understanding the cost structure of collectibles insurance helps collectors make informed decisions about protecting their investments. Unlike the severe limitations of homeowners insurance, dedicated collectibles coverage provides comprehensive protection at surprisingly affordable rates.

According to industry data from Progressive Insurance and specialized providers, collectibles insurance typically costs between $1 to $5 annually per $1,000 of coverage. This means a $10,000 collection might cost just $10 to $50 per year to insure – a minimal expense compared to the potential loss of an uninsured collection.

The actual premium you’ll pay depends on numerous factors that insurers evaluate when underwriting policies. The type of collectible significantly impacts rates, with easily portable items like coins and stamps typically costing more to insure than large items like furniture or sculptures. According to Distinguished Programs, smaller items face higher theft risk, leading to higher premium rates.

Geographic and Storage Factors

Your location plays a crucial role in determining premiums. Collections stored in areas prone to natural disasters such as hurricanes, wildfires, or earthquakes face higher rates. Urban areas with higher crime rates also see increased premiums compared to rural locations. However, even in high-risk areas, collectibles insurance remains affordable compared to the value being protected.

Storage conditions significantly impact your premium. Collections kept in climate-controlled environments with security systems pay lower rates than those in basic storage. Professional storage facilities with environmental controls and security can reduce premiums by 20-30%. Home storage with alarm systems and safes also qualifies for discounts, while collections stored in basements or attics might face surcharges due to increased risk of water damage or extreme temperatures.

Cost Example: A $50,000 sports card collection stored in a climate-controlled room with a security system might cost $250-$400 annually to insure (0.5-0.8% rate). The same collection stored in an unprotected basement could cost $500-$750 annually (1.0-1.5% rate).

Premium Factors and Cost Ranges

| Factor | Low Risk/Cost | High Risk/Cost | Impact on Premium |

|---|---|---|---|

| Collection Value | Under $25,000 | Over $250,000 | Base calculation |

| Item Portability | Large, difficult to move | Small, easily stolen | ±20-40% |

| Storage Security | Alarm, safe, climate control | Basic home storage | ±15-30% |

| Geographic Location | Low crime, no disasters | Urban, disaster-prone | ±25-50% |

| Deductible | $1,000+ | $0 | ±20-35% |

| Collection Type | Art, furniture | Jewelry, coins | ±30-60% |

| Claims History | No claims | Multiple claims | ±40-100% |

Major Insurance Providers and Their Specialties

Choosing the right insurance provider for your collection requires understanding each company’s strengths, specialties, and unique offerings. The collectibles insurance market includes both specialized insurers focused exclusively on collections and major insurance companies offering collectibles as part of broader valuable articles coverage.

Specialized Collectibles Insurers

Collect Insure (CIS) has protected collections since 1966, making them one of the most experienced providers in the market. They offer coverage starting at $0 deductibles and don’t require appraisals for most items under $25,000. Their automatic monthly increase option provides up to 1% monthly coverage increases (up to $1 million total) to account for appreciation, particularly valuable for rapidly appreciating markets like trading cards.

American Collectors Insurance specializes in agreed value coverage and offers some of the best inflation protection in the industry, with automatic inflation guard up to 6% compared to the standard 4%. They provide free perks including basic towing, repair shop choice, and automatic coverage for new acquisitions during the policy term. Their expertise spans from vintage toys to fine wine, with specialized knowledge in each category.

MiniCo Collectibles Insurance, administered through Jencap, focuses on smaller to medium-sized collections with streamlined online applications and instant quotes for collections under $250,000. They offer worldwide coverage and don’t require itemization for collections under certain thresholds, making them ideal for collectors who want simple, comprehensive protection without extensive documentation.

Major Insurance Companies

Chubb represents the high-end market, catering to substantial collections and high-net-worth individuals. They only require appraisals for items valued at $50,000 or more and offer market value coverage up to 150% of scheduled amounts for appreciating items. Their worldwide coverage and expertise with fine art and jewelry make them ideal for serious collectors with diverse, valuable holdings.

Allstate offers collectibles coverage as an addition to existing homeowners policies, providing convenience for customers who prefer bundling their insurance needs. While not as specialized as dedicated collectibles insurers, they offer competitive rates for moderate-value collections and the convenience of single-company coverage.

State Farm and Progressive offer collectibles coverage through riders or separate policies, with Progressive particularly competitive for collections under $50,000. These mainstream insurers provide the advantage of local agents and established relationships, though their collectibles expertise may not match specialized providers.

The Claims Process: What to Expect

Understanding the claims process before you need it ensures you’re prepared to act quickly and effectively if loss occurs. The collectibles insurance claims process differs significantly from standard homeowners claims, with specialized adjusters who understand collector markets and values.

Immediate Steps After a Loss

Your first priority after discovering a loss is ensuring safety and preventing further damage. For theft, immediately file a police report and obtain a copy for your insurance claim. For damage from fire, water, or other perils, take steps to prevent additional damage, such as covering broken windows or moving undamaged items to safety. Document everything with photos and videos before moving or cleaning anything.

Contact your insurance provider immediately, even if you’re unsure about the extent of the loss. Most collectibles insurers have 24/7 claim hotlines staffed by specialists who understand the unique nature of collections. They can provide immediate guidance on protecting remaining items and beginning the documentation process.

Documentation and Valuation

The strength of your claim depends largely on your documentation. Insurers will request proof of ownership such as receipts, invoices, or provenance documentation, photos of damaged or stolen items, including detailed images showing condition prior to loss, current market valuations from price guides, recent auction results, or dealer quotes, and any appraisals or grading certificates for high-value items.

For agreed value policies, the claims process is straightforward since values were predetermined. For market value or blanket coverage, you’ll need to establish current replacement costs. Many insurers work with specialized collectibles experts who can accurately assess values based on current market conditions.

Claims Tip: Maintain detailed inventory records including photos, receipts, and valuations in multiple locations – physical copies in a safe deposit box and digital copies in cloud storage. This redundancy ensures you can document your claim even if your primary records are destroyed.

Common Exclusions and Coverage Limitations

While collectibles insurance offers far broader coverage than homeowners policies, understanding exclusions and limitations helps avoid unpleasant surprises during claims. Every policy has boundaries, and knowing these in advance allows you to address potential gaps or adjust your risk management strategies.

Standard Exclusions

Gradual deterioration remains universally excluded across all collectibles policies. Insurance covers sudden and accidental damage, not the natural aging process. This means foxing on comic books, toning on coins, or fading on trading cards isn’t covered. Similarly, damage from insects, vermin, or mold typically falls outside coverage unless resulting from a covered peril.

Intentional damage or mysterious disappearance without evidence of theft may not be covered by all policies. While some insurers offer mysterious disappearance coverage, others require proof of forced entry or other evidence of theft. Understanding your policy’s stance on unexplained losses is crucial for collections with many small, valuable items.

Special Circumstances and Restrictions

Many policies include specific restrictions based on how and where collections are used or displayed. Collections used for business purposes, such as dealer inventory or items regularly sold, require commercial coverage rather than personal collectibles insurance. Items on consignment or loan to museums might need special endorsements to maintain coverage.

Geographic restrictions can apply, particularly for international travel or shipping. While many policies offer worldwide coverage, some exclude certain countries or require notification for international transport. Exhibition coverage might be limited or require additional premiums if you display your collection at shows or conventions.

Important Exclusion: War, terrorism, and nuclear hazards are typically excluded from all collectibles policies. Additionally, government confiscation or destruction of illegal items receives no coverage, making provenance and legal ownership documentation essential for international or historically significant pieces.

Exclusions and Special Considerations

| Exclusion/Limitation | What’s Not Covered | Potential Solutions | Additional Cost |

|---|---|---|---|

| Gradual Deterioration | Aging, foxing, toning, fading | Proper storage and conservation | N/A – Prevention only |

| Mysterious Disappearance | Items that “go missing” | Add disappearance coverage | +10-15% premium |

| Exhibition/Show Risk | Damage at shows or in transit | Exhibition endorsement | +$50-200 per event |

| International Coverage | Losses outside home country | Worldwide coverage option | +15-25% premium |

| Pairs and Sets | Lost value of remaining items | Pairs and sets clause | +5-10% premium |

| Business Use | Dealer inventory, sales | Commercial policy | 2-3x personal rates |

| Flood/Earthquake | May be excluded in some areas | Specific peril coverage | +20-50% in risk areas |

Storage and Security Requirements

Insurance providers evaluate storage and security measures carefully when underwriting collectibles policies. Your storage methods not only affect your premium rates but might determine whether you can obtain coverage at all. Understanding these requirements helps you optimize both protection and insurance costs.

Environmental Controls

Climate control represents one of the most critical factors for many collections. Paper-based items like comics, cards, and stamps require stable temperature and humidity to prevent deterioration. Insurance companies often require or strongly recommend maintaining temperatures between 65-70°F with relative humidity between 35-50% for paper collections. Wine collections need even more specific conditions, typically 55-57°F with 60-70% humidity.

For collections without climate control, insurers might impose surcharges or coverage restrictions. According to industry guidelines, collections stored in uncontrolled environments like attics, basements, or garages face premium increases of 20-40% due to increased risk of damage from temperature extremes, humidity, and pests.

Physical Security Measures

Security requirements vary based on collection value and type. For collections under $25,000, basic home security like deadbolts and smoke detectors might suffice. Collections valued between $25,000 and $100,000 typically require burglar alarms connected to central monitoring stations. For collections exceeding $100,000, insurers might mandate safes or vaults for small valuable items, motion detectors and glass-break sensors, video surveillance systems, and restricted access controls.

According to Distinguished Programs, collections must be stored at least several inches off the ground to prevent water damage, a requirement called a “stillage warranty.” This seemingly simple requirement can prevent total losses from minor flooding or pipe breaks that might otherwise destroy entire collections stored in cardboard boxes on floors.

Tips for Reducing Your Collectibles Insurance Premiums

While collectibles insurance remains affordable relative to the protection provided, several strategies can further reduce your premiums without sacrificing coverage quality. These approaches require initial investment or effort but generate ongoing savings that compound over time.

Security and Storage Improvements

Investing in security infrastructure provides both better protection and insurance savings. Installing a monitored alarm system can reduce premiums by 15-20%, often paying for itself within 2-3 years through insurance savings alone. Adding specific collectibles protection like safes for coins or UV-filtering glass for artwork demonstrates serious risk management that insurers reward with lower rates.

Professional storage solutions, while requiring upfront investment, significantly reduce premiums. Climate-controlled storage units designed for collectibles might cost $100-300 monthly but can reduce insurance premiums by 25-30% while providing superior protection. For valuable collections, the combined cost of professional storage and reduced insurance often equals or beats the cost of home storage with higher insurance rates.

Documentation and Inventory Management

Comprehensive documentation streamlines underwriting and claims processing, often resulting in better rates. Maintain detailed inventories with photos, purchase receipts, and current valuations. Digital inventory management systems that track your collection with photos, values, and purchase history demonstrate professionalism that insurers appreciate.

Regular appraisals for high-value items, while costing money upfront, can prevent underinsurance and ensure smooth claims processing. Many insurers offer premium discounts for collections with professional appraisals less than three years old, recognizing the reduced risk of valuation disputes.

Policy Structure Optimization

Choosing appropriate deductibles significantly impacts premiums. Increasing your deductible from $0 to $1,000 might reduce premiums by 25-35%. For large collections where a $1,000 loss would be manageable, this strategy provides substantial long-term savings. Some collectors use graduated deductibles – higher for common perils like theft, lower for catastrophic events like fire.

Bundling multiple collections under one policy often generates discounts of 10-15%. If you collect both sports cards and comics, insuring them together typically costs less than separate policies. Similarly, some insurers offer multi-policy discounts when you carry both collectibles and valuable articles (jewelry) coverage.

Money-Saving Strategy: Consider seasonal adjustments for collections you actively trade or display. Some insurers allow you to increase coverage during convention season or reduce it during periods of inactivity, optimizing your premium spend throughout the year.

Digital Age Considerations: NFTs and Online Collections

The digital revolution has created entirely new categories of collectibles, challenging traditional insurance models. NFTs (Non-Fungible Tokens), digital art, and virtual items in games represent billions in value, yet insurance coverage for these assets remains in its infancy.

Some forward-thinking insurers now offer coverage for digital assets, though terms and conditions vary significantly. Coverage typically requires proof of ownership through blockchain records, secure wallet storage with private key management, and clear documentation of purchase price and current market value. Challenges include extreme price volatility, evolving legal frameworks around digital ownership, and technical risks like wallet hacks or lost keys.

For collectors with significant digital holdings, specialized crypto and digital asset insurance might provide better coverage than traditional collectibles policies. These policies address unique risks like smart contract failures, exchange hacks, and key loss while providing coverage based on blockchain-verified ownership.

Building and Maintaining Your Collection with Insurance in Mind

Smart collectors consider insurance implications when building and managing their collections. This forward-thinking approach not only ensures adequate protection but can also enhance your collection’s value and marketability.

Purchase Documentation

Establish robust documentation practices from the start. For every acquisition, maintain purchase receipts or invoices, certificates of authenticity, provenance documentation, condition reports or grading certificates, and photographs from multiple angles. This documentation serves multiple purposes beyond insurance, including establishing provenance for future sales and tracking your collection’s appreciation for tax purposes.

Digital documentation stored in multiple locations provides security against loss. Cloud storage services offer convenient access and automatic backup, while physical copies in safe deposit boxes provide redundancy. Some collectors use specialized collection management software that integrates inventory tracking, valuation updates, and insurance documentation.

Regular Valuation Updates

Collection values fluctuate with market conditions, making regular revaluation essential. Review your coverage annually, comparing current market values to your policy limits. Significant market movements might necessitate mid-year adjustments – the recent explosion in trading card values caught many collectors dangerously underinsured.

Maintain relationships with dealers, auction houses, and appraisers who can provide current market intelligence. Many provide informal valuations for insurance purposes, helping you maintain appropriate coverage without formal appraisal costs. Online price guides and auction databases offer real-time market data for many collectibles, though insurers might require professional appraisals for high-value items.

When to Get Collectibles Insurance: Key Triggers

Recognizing when to transition from homeowners coverage to dedicated collectibles insurance prevents costly coverage gaps. Several triggers should prompt immediate insurance review and likely upgrade to specialized coverage.

The most obvious trigger is when your collection value exceeds homeowners insurance sublimits. If your collection is worth more than $2,500-5,000 (typical sublimits), you need additional coverage. Even collections below sublimits might benefit from collectibles insurance’s broader coverage and lower deductibles.

Life events often necessitate insurance reviews. Inheritance of valuable collections, marriage combining two collections, divorce requiring collection division, or retirement with increased collecting activity all warrant insurance evaluation. Geographic moves, especially to disaster-prone areas, should trigger coverage review and possible carrier changes.

Market appreciation can rapidly push collections beyond existing coverage. The recent surge in trading card, video game, and modern comic values left many collectors underinsured virtually overnight. Regular market monitoring ensures your coverage keeps pace with appreciation.

Insurance Trigger Checklist: Review your collectibles insurance if your collection value exceeds $5,000, you inherit or acquire a significant collection, you start displaying at shows or online, market values increase significantly, you move to a new location, or you experience any loss or near-miss that reveals coverage gaps.

Conclusion: Protecting Your Passion and Investment

Collectibles insurance represents far more than just financial protection – it’s about preserving the passion, memories, and investments that define your collecting journey. The stark reality that standard homeowners insurance might cover less than 5% of your collection’s value should serve as a wake-up call for every serious collector.

The good news is that comprehensive collectibles insurance remains remarkably affordable, typically costing just $1-5 per $1,000 of coverage annually. This means even substantial collections can be properly protected for a few hundred dollars per year – less than many collectors spend on supplies or single acquisitions. When compared to the devastating financial and emotional impact of an uninsured loss, collectibles insurance becomes not just advisable but essential.

As we’ve explored throughout this guide, the collectibles insurance landscape offers flexible solutions for every type of collector, from casual hobbyists to serious investors. Whether you collect vintage baseball cards, fine art, rare coins, or modern sneakers, specialized coverage exists to protect your unique assets. The key lies in understanding your options, accurately valuing your collection, and choosing coverage that aligns with your collecting goals and risk tolerance.

Take action today by inventorying your collection, understanding your current coverage limitations, and obtaining quotes from specialized insurers. Don’t wait for a loss to discover you’re underinsured. Your collection represents years of passion, knowledge, and investment – protect it with insurance designed specifically for collectors who understand that true value extends far beyond simple replacement cost.

Frequently Asked Questions

Q: Is collectibles insurance worth it for small collections?

Even collections worth $5,000-10,000 benefit from dedicated coverage. At approximately $50-100 annually, collectibles insurance costs less than a single valuable item while providing comprehensive protection that homeowners insurance can’t match. The broader coverage, including accidental damage and mysterious disappearance, makes it worthwhile for any serious collector.

Q: How does collectibles insurance differ from scheduling items on my homeowners policy?

While scheduling items on homeowners insurance increases coverage limits, collectibles insurance offers superior protection with broader covered perils, specialized claims handling by experts who understand collector markets, no impact on homeowners premiums or claims history, and often lower deductibles or zero deductibles. Collectibles insurance also typically costs less than scheduling items on homeowners policies.

Q: What documentation do I need to get collectibles insurance?

Requirements vary by value and insurer. Collections under $25,000 typically need just a general inventory with estimated values. Items over $25,000-50,000 might require receipts, appraisals, or authentication documents. Most insurers don’t require professional appraisals for items under $25,000, accepting collector estimates based on current market values.

Q: Does collectibles insurance cover items I sell online or at shows?

Personal collectibles insurance typically excludes business activities. If you regularly sell items, you need commercial or dealer coverage. However, occasional sales of personal collection items are usually covered. Some policies include limited coverage for displays at shows or conventions, though you might need an exhibition endorsement for full protection.

Q: How quickly can I get collectibles insurance coverage?

Many insurers offer immediate coverage upon application approval and payment. Online applications for collections under $250,000 can often be completed in 15-30 minutes with instant quotes. Coverage typically begins immediately upon payment, though high-value collections might require additional underwriting time.

Q: Will filing a collectibles insurance claim affect my homeowners insurance rates?

No, collectibles insurance claims are completely separate from homeowners insurance. Filing a claim on your collectibles policy won’t impact your homeowners premiums or claims history. This separation represents a significant advantage of dedicated collectibles coverage.

Q: Can I insure a collection stored in multiple locations?

Yes, most collectibles policies cover items regardless of location, including home, bank safe deposit boxes, professional storage facilities, and even temporary locations like shows or exhibitions. You’ll need to inform your insurer about all storage locations, and premium rates might vary based on the security and environmental controls at each location.

Q: What happens if my collection appreciates beyond my coverage limits?

Many insurers offer inflation guard or automatic increase options that adjust coverage for appreciation. Some policies include automatic coverage up to 125-150% of scheduled values. However, you should review coverage annually and adjust limits for significant appreciation. Being underinsured means receiving only partial compensation for losses.

Q: Do I need to maintain an inventory for my collection?

While not always required for coverage, maintaining a detailed inventory is strongly recommended. It streamlines claims processing, helps track appreciation, and ensures adequate coverage. Modern collectors use apps and software to maintain digital inventories with photos, values, and purchase information, making documentation manageable even for large collections.

Q: Can I get collectibles insurance if I’ve had previous claims?

Previous claims don’t automatically disqualify you from coverage, though they might affect premiums. Insurers evaluate claim history, considering frequency, cause, and resolution. Multiple claims might result in higher premiums or deductibles, but specialized collectibles insurers understand that collections face unique risks and are often more accommodating than standard insurers.